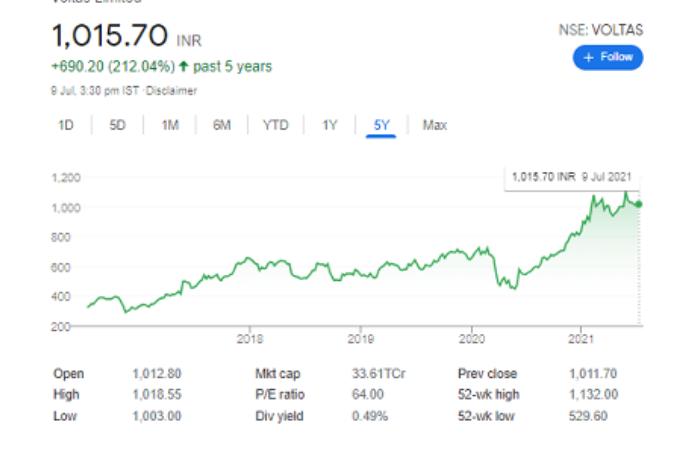

NSE VOLTAS – NSE, or The National Stock Exchange, is India’s largest financial and stock market. It was incorporated in 1992. The National Stock Exchange of India Limited was the first stock exchange in India. It provides modern, fully automated electronic trading. The NSE has established a sophisticated electronic market, ranked fourth globally by equity and derivatives trading volume. Trading commenced in 1994 with the introduction of the wholesale debt market and a cash market segment shortly after that.

Voltas Limited is an Indian multinational home machines and consumer electronics company headquartered in Mumbai. The company name is a combination of the Volkart Brothers and Tata Sons. It designs, develops, creates, and sells products, including air cleaners, refrigerators, washing machines, dishwashers, microwaves, and water distributors. The company was incorporated in Mumbai on September 6, 1954, as a partnership connecting Volkart Brothers and Tata Sons. Noel Tata currently manages the company. Its shares are openly traded on the Bombay and India National Stock Exchange.

Voltas is jointly owned by the $311 billion corporation Tata Group and Blue Star. It controls nearly 35 percent of the room AC market in India. Yet, 2022 could not have been more conflicting for these two companies.

It takes us to whether two companies in the same industry, selling a standard product, face equal competition and inflationary pressures. Yet, their share price returns on a year-to-date basis suggest otherwise.

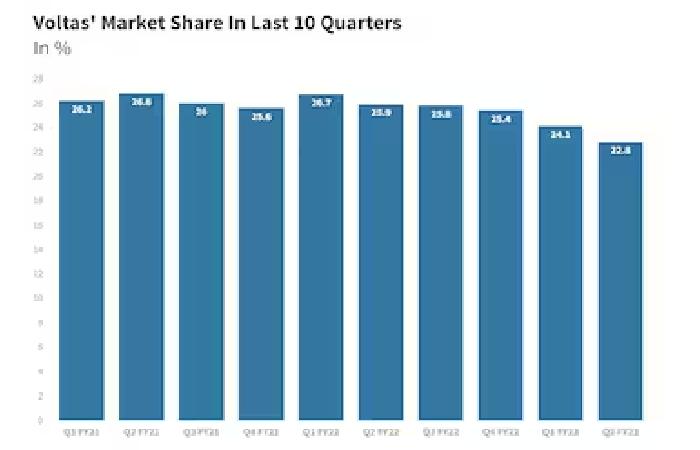

Over the last ten quarters, Voltas has lost nearly 4 percent of its market share. For the September quarter of the current financial year, the company’s market share stood at 22.8 percent, as stated in their earnings call, compared to the 26.8 percent peak during the September quarter of the financial year 2021.

Why is Voltas losing market share?

A brand from Havells India’s stable has expanded a significant stake in the Northern part of India over the last few years. During COVID-19, most companies, including Voltas, struggled with supply-chain issues. At that time, Lloyd (A brand from Havells) was the only player that came up with a new plant due to its high demand in the northern states of India. Although Voltas is a dominant player in the Northern and Southern parts of the country, it is trying hard to protect its margin on each AC sold. Also, it is simultaneously trying to limit the dent in its market share. During their March quarter earnings call of the last financial year FY 22, Voltas’ management also ascribed the drop in market share. The reduction in the market share is due to the price interruptions by competitors.

When we look at January, February, and March, summer precisely comes into the market of the South zone. And in the Southern market, when we look at the price, disruption by the other players has contributed to this fall in the market share. In the summer of 2022, Voltas earned more revenue. But sold fewer ACs due to the 5-6 percent price hikes it took in April. While Blue Star did not hike AC prices, it targeted price-sensitive customers and first-time buyers through the ‘mass premium’ range, launched in March 2020. Analysts said Voltas offered additional discounts in May to compensate for the lost market share.

Five reasons for Voltas share price going down:

There may be many reasons for the downfall of India’s premier Electronic brand, but here are our top five reasons we think are the obligations affecting their performance at the National stock exchange.

- Brokerage firm CLSA (Credit Lyonnais Securities Asia)has retained its ‘sell’ call on the stocks, predicting a negative business outlook. However, Some brokerage firms may have cut their price target on Voltas but have booked their buy recommendations. UBS cut its current financial year EPS estimates by 36 percent to build in demand and EBITDA margin softness. It expects the company’s growth to taper in the near term. However, despite the cut in price target to Rs 1,330 from Rs 1,450, the brokerage has maintained its buy rating for now.

- New orders are coming but at a lower EBIT ( earning before interest and tax), making Voltas’ share price sore in NSE. Increased taxes on Consumer goods and electronics are also a reason for the decline in the movement of new orders, affecting the share price in NSE.

- Voltas has been implementing the $2.5 billion Sidra Medical & Research Centre hospital project in Qatar since 2008, where its scope of work is around ₹ 1,000 crore—cost-overruns in the Sidra project Voltas 115 crores rupees due to upward revision in the estimated project cost.

- Although Voltas is an Indian company, Middle Eastern countries are Voltas’ most significant market. Although the summer season is going through the Middle East, people were not placing large ticket orders from there, which accounts for the most essential demands for the company. Out of the company’s total order value of ₹ 4,700 crores (as of December 31), the Middle East accounted for ₹ 3,100 crores, more than 60% of their complete orders. There are few signs of a revival of capital expense in the domestic market. India is the biggest market for the company after the Middle East.

- Voltas also produces textile manufacturing equipment, which is also going in negative demand due to low consumption.

Additional Reasons for Voltas share price going down:

There may be other reasons. These reasons are slowness in the Global economy due to the Russia- Ukraine conflict and the Middle East. The blood bath of other premium stocks in NSE can also cause uncertainty in the stock market.

Suppose Voltas wants to rejuvenate its position in NSE. In that case, it needs to counter these obstacles to gain the trust of the investors, especially from CLSA, as the “Sell” stand from CLSA has a significant impact on other investors to decide their position in this jingled situation and also for those who rely on these investment and brokerage firms to predict the outcomes for their investments.